The check was in principle obsolete as a means of payment many years ago. In this country, you can either pay in cash, deposit a check with your giro card, credit card, or over the Internet using PayPal or via other payment services. The check is no longer even used for a fraction of all payments so that it is hardly ever listed in statistics. But checks continue to play a not insignificant role abroad. A good example of this is France, where checks are still an important means of payment in everyday life. Checks still play a crucial role in the United States and in many other countries. Checks are still used, especially when it comes to cross-border payments. So if you get a check, you should know how to turn that piece of paper into money.

Where can I get checks these days? deposit a check

Due to the relevance of checks abroad, you will receive a check first and foremost when you pay out abroad – for example when you sell a book or other item. But even in Germany, it can happen in exceptional cases that you will not receive a transfer or credit on your card, but a check (see below). Although this is unusual in normal business operations, there are such cases. Checks, for example, are still issued today in these areas:

Basically, whenever you receive a check, it is a credit note. case of a health insurance company, for example, this is usually a fee reimbursement. In some cases, submitted invoices can also be paid by means of a crossed check. In the meantime, however, this only happens very rarely. At Techniker Krankenkasse, payment by bank transfer is preferred, at AOK, payments by check are only carried out by a few directorates and in exceptional cases (as of 10/2017).

It’s similar to insurance: whenever you get money back from insurance, for example in the event of a claim or a refund, there is a certain probability that you will receive a check. Most providers have changed their conditions in the meantime, but some insurance companies pay out damage amounts with a check-in individual cases. This applies to Gothaer Versicherung, Allianz, AXA and Signal Iduna, among others. With some other insurance companies, including DEVK and NÜRNBERGER Versicherung, payments by check are no longer possible (as of 10/2017).

operators of deposit a check

Finally, there are also tour operators who payout by check: crossed checks use by tour operators for refunds. This is the case, for example, if a trip cannot carry out as promised, you as a customer cancel (minus any possible fees) or if part of the travel amount is refunded as reimbursement for problems. In most of these cases, you can choose whether you would like a refund or a voucher from the organizer. Reimbursement by check is still possible, for example, from Thomas Cook (as of 10/2017).

In addition to the aforementioned groups of companies, there are also cross-checks in a number of other areas. This includes buying valuable precious metals such as gold or jewelry on the Internet. Most providers advertise that you either do a bank transfer or send a personal check for the payout. You can also order checks from almost all banks. This is possible at Commerzbank, Deutsche Bank, and HypoVereinsbank, among others. However, some institutes have stopped issuing checks.

Are there different types of checks?

When you receive a check, the cashing process is not always the same. This is because there are a total of three different types of checks:

Personal checks are the easiest and least secure form of checks. In Germany, there are actually almost no cash checks at all anymore. In principle, a cashier’s check is comparable in value to cash. You can go to a bank branch with this check and have the cash value of the check payout – provides that the account to debits has sufficient funds. In principle, anyone can cash a check without using an account number or the like.

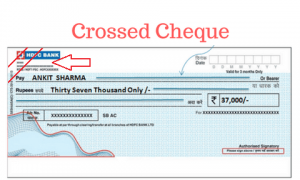

crossed check: deposit a check

The crossed check has compared extra safety. If you receive a crossed check, you can still cash it at a bank without any problems, but you must always state your bank account. If a checkmarks “for settlement”, it can only cash on your own account. This also serves as a means of tracking. In the event of fraud, the money’s path is easier to understand. In addition, a name store for each account, so that it is easier to follow up in the event of fraud. Furthermore, the credit is only made with reservations until the redeeming bank has to check whether the account to be debited (usually with another bank) has the necessary funds.

The order check is, in principle, a further version of the cross-check that intends to provide additional security. In the case of an order check, the conditions for redemption are tight. The name of the person who can cash the check notes on every order check. Due to this limitation, the check cannot cash by everyone, including family members. If the check falls into the wrong hands, it is in principle worthless for the person concerned. Above all, this avoids any kind of check fraud.

Redemption

How do I cash a check at a branch bank?

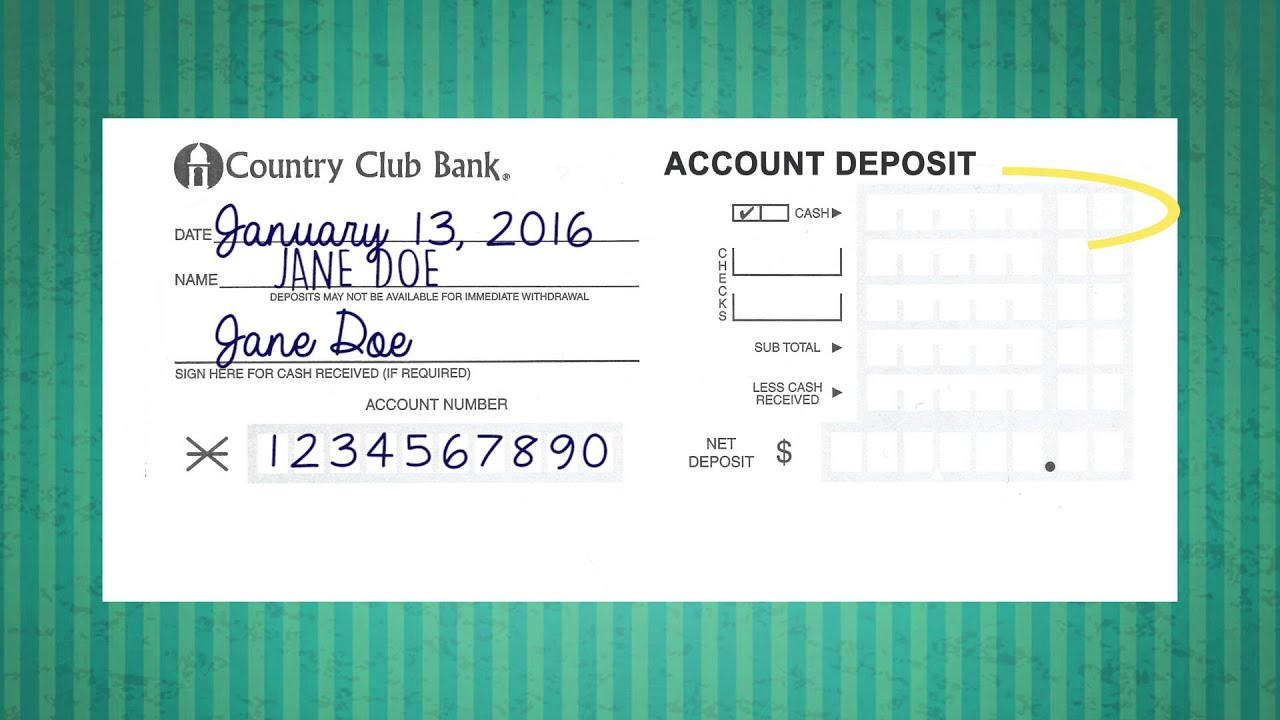

If you want to cash a check, you usually need a form from your bank. On the check deposit form, you must complete all relevant aspects of the check. In addition to the form, you must of course also present the check yourself. Credit can only issue if both documents have completes in full and the check has signs by the issuer. The bank always marks the check with the note “subject to change”. The check only credit when the bank receives the necessary money from the issuer’s account.

In principle, it should be possible to cash checks at all branch banks, but there are still problems. When a bank deals with a check for the first time, it usually has a hard time cashing it. In addition, when cashing a check, you must always make sure that you fill out all fields on the form completely and thoroughly. Even small mistakes make the submission impossible. In addition, the check must fill out correctly by the issuer – otherwise, it is generally impossible to cash it. This also always applies if a check not sign. Checks can cash at all well-known branch banks in Germany (as of 10/2017).

How do I cash a check at a direct bank?

With direct banks, cashing a check seems more complex at first because you don’t have a direct contact person there. However, at some institutions, it is even easier to hand in checks than at branch banks. For example, some banks simply require the check to submit by letter and a note with the name, IBAN, BIC, and possibly a sign of the recipient. This applies, for example, to these institutes:

Most other direct banks, like the branch banks, require a form in addition to the check on which you have to enter the relevant data. In addition to the check, you must also submit a form to these banks, among others:

- Consorsbank and DAB Bank

- German Credit Bank (DKB)

- Netbank

- Wüstenrot direct

You can download the form from all of the banks mentioned simply and easily from the Internet. As soon as you have filled out the form thoroughly, you can send it together with the check to the address on file. The credit will then credit to your account a few days later. Cashing a check at a direct bank sometimes takes a little longer due to the postal service, but otherwise cashing a check is not necessarily more complicated. However, you should note that a distinction is sometimes made between forms for domestic and international checks. Checks can cash at all major direct banks in Germany (as of 10/2017).

Also Read: How to sterilise jars

14 thoughts on “How to deposit a check?”

novasportfm

(November 3, 2023 - 9:23 pm)Excellent article! We will be linking to this particularly great article on our website. Keep up the good writing.

Radio Maria Australia

(November 4, 2023 - 3:52 pm)Great post Thank you. I look forward to the continuation.

newsmax livestream

(November 7, 2023 - 5:14 pm)This was beautiful Admin. Thank you for your reflections.

bbcpersian

(November 9, 2023 - 5:15 am)Pretty! This has been a really wonderful post. Many thanks for providing these details. Watch bbcpersian

ELMAS TV

(November 11, 2023 - 12:08 am)There is definately a lot to find out about this subject. I like all the points you made

live racing stream

(November 15, 2023 - 4:13 am)I m often to blogging and i really appreciate your content. The article has actually peaks my interest.

Will it ever be possible for time travel to occur?

(November 15, 2023 - 5:48 am)I m going to bookmark your web site and maintain checking for brand spanking new information.

How to Listen to SiriusXM Radio Online

(November 26, 2023 - 5:43 pm)This is my first time pay a quick visit at here and i am really happy to read everthing at one place

Newsmax TV Live

(November 26, 2023 - 6:08 pm)I do not even understand how I ended up here but I assumed this publish used to be great

binance Code

(March 6, 2024 - 11:43 pm)I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

зарубежные сериалы смотреть онлайн

(March 22, 2024 - 4:56 am)Hi i am kavin, its my first time to commenting anywhere, when i read this piece of writing i thought i could also make comment due to this sensible article.

глаз бога бот

(April 10, 2024 - 7:26 am)Way cool! Some very valid points! I appreciate you writing this article and the rest of the site is extremely good.

глаз бога телеграмм

(April 10, 2024 - 8:45 pm)obviously like your web-site however you need to test the spelling on quite a few of your posts. A number of them are rife with spelling problems and I in finding it very bothersome to tell the truth then again I will certainly come back again.

new cs2 skins gamble sites

(May 7, 2024 - 11:40 pm)Greetings from Carolina! I’m bored to tears at work so I decided to check out your site on my iphone during lunch break. I enjoy the info you present here and can’t wait to take a look when I get home. I’m amazed at how quick your blog loaded on my mobile .. I’m not even using WIFI, just 3G .. Anyhow, amazing site!